The changing shape of multi-asset investing

New horizons - and challenges - emerge in the quest for diversification

Multi-asset funds have become crucial tools for advisers over the past decade, and it has been relatively plain sailing so far.

But there are reasons to think returns will be harder to come by in the years ahead.

This special supplement asks what intermediaries need to consider in future, as well as taking a closer look at Fidelity’s multi-asset offering.

The rise of the risk takers

How the past decade of low interest rates has affected investment behaviours

"Only with a disciplined approach to asset class and instrument selection can alternatives really aid a portfolio"

Changes to the regulatory landscape and the way advisers do business have driven demand for multi-asset funds in recent years.

The Retail Distribution Review in 2013 and the Mifid rules, which came into effect at the start of 2018, have increased the visibility and transparency of the fees clients pay for the products they buy from advisers, including investment products.

At the same time, the ever-changing landscape of pension and tax rules has increased demand for advisers to provide financial planning advice in those areas, reducing the amount of time many advisers can spend creating a portfolio of investment funds for clients.

The response of many advisers in the market has been to outsource the investment management function, allowing them to concentrate on other aspects of their business.

The three ways in which advisers typically outsource are via multi-asset funds, model portfolio services and bespoke portfolios provided by discretionary fund managers.

The latter pair often require a client to have a minimum pot of assets in order to gain access, and can often have higher fees than a multi-asset fund.

Creating a portfolio of funds involves a number of decisions, the first of which relates to asset allocation: deciding in what proportion to invest in equities, bonds, cash and alternative assets.

Asset allocation used to be more straightforward, as bonds and equities tended to move in opposite directions, so an investor who wanted to reduce risk bought more bonds, and to increase risk bought more equities.

But the persistently low interest rates of the past decade have eroded those certainties, and made it even more difficult and time consuming for advisers to carry out investment management.

Darius McDermott, managing director at ratings agency FundCalibre, says multi-asset funds are “a one-stop shop in terms of investments, offering diversification and experts who can not only pick the underlying assets for you but also do the asset allocation”.

But that is not their only use. Such strategies can also be used to replace specific asset classes in a portfolio, as Aurèle Storno, chief investment officer for multi-asset at Lombard Odier, notes.

He says: “We can observe that investors use them in different ways: some are interested in the specific portfolio construction expertise of the strategy and its diversification potential; others seek replacement opportunities.

“For example, a conservative strategy with good diversification and active loss management can be considered as a replacement for fixed income, potentially enhancing return for comparable risk levels, while more ambitious multi-asset growth portfolios can be thought of as equities substitutes with a more contained risk of loss.”

For Wesley Coultas, investment director at wealth manager Walker Crips, the principal advantage of multi-asset funds is that they allow investors with even a small pot of assets to invest in a way that is more diversified than if they were trying to construct the portfolio using individual funds.

The latter tend to have minimum investment levels, so a small pot of assets can only be invested in a small number of funds, whereas buying a multi-asset fund allows for a broader exposure.

He says: “Whether we use multi-asset funds or not depends on the size of the portfolio.

“For smaller portfolios, they are most useful as they give you the diversification that you may not have been able to get if you would have bought them individually.”

For multi-asset managers themselves, the investment conditions seen over the past decade have been transformative.

Rock-bottom interest rates have helped almost all investments achieve a healthy return since 2008.

In the past five years alone, even the average fund in the Investment Association’s Flexible Investment sector has returned 37 per cent.

The ultra-cautious Mixed Investment 0%-35% Shares sector, meanwhile, has returned 20 per cent on average.

Nick Watson, multi-asset investor at Janus Henderson Investors, agrees the tendency of monetary policy to push the value of all assets higher over the past decade has created a world where asset allocation became less important because everything went up.

But, he says, because of increased volatility since 2018 – when the US Federal Reserve began to pare back its QE policy – and the increased political risks around the world, markets have become less predictable and asset allocation has come back into vogue.

Stephen Doran, multi-asset client portfolio manager at Russell Investments, agrees.

He says the nature of stock market performance over the past decade has been that small parts of markets have performed very well and dragged up market averages as a whole.

He adds this has meant the approach of having a diversified portfolio – as is typical for multi-asset – has looked like the wrong thing to do.

He says: “Between 2009 and 2018, investors hadn’t really needed to worry about portfolio construction or diversification.

QE and negative interest rates crushed volatility, depressed bond yields and boosted returns in every asset class.

Investors just had to buy one bond and one equity market to deliver strong total returns with historically low levels of volatility.

“However as we look at the market and take the performance of 2018 and 2019 as a template of lower returns and more volatility for the future, portfolio construction will become an important asset in smoothing client outcomes.”

Rising valuations in traditional asset classes, such as equities and fixed income, mean that for many investors alternatives are starting to play a much larger role.

This asset class encompasses everything from absolute return funds to infrastructure, renewable energy, commodities and a variety of other esoteric assets.

The complexity of some of these offerings is such that they tend to be the reserve of professional investors.

Mark Jackson, product specialist at JPMorgan Asset management, revealed that while his company used to divide the market into five asset classes when constructing a portfolio, this number has now risen to 14 as they seek to increase diversification.

But not all such buyers treat alternatives in the same way.

Data from Asset Allocator, a sister publication to Financial Adviser that focuses on discretionary fund managers, shows the average allocation to alternatives in a balanced model portfolio stood at 17 per cent at the start of last year, compared with 11 per cent for equivalent multi-asset funds.

At the same time, however, multi-asset managers have tended to make more use of the options available to them.

Wealth managers tend to hold more client money in a small handful of alternative funds, whereas multi-asset vehicles often spread their assets across a wider range of offerings.

Alternatives can also provide a valuable source of income, which again is a useful attribute at a time when both bonds and equities yield less than they once did.

Mixing and matching assets can create other issues.

As portfolio construction becomes more sophisticated, the need to measure correlations between asset classes is also of growing importance.

It is not just a case of simply pondering whether government bonds will move inversely to equities in future – even if this, too, is no longer a given.

High-yield bonds, for example, track share price movements relatively closely.

The need to measure correlations between asset classes is also of growing importance

And even some alternatives can prove more closely correlated to conventional assets than buyers may expect.

So building a portfolio fit for the future is becoming more challenging – and sticking to the old ways of doing things is unlikely to be a sensible strategy.

Searching for a different approach

Is the writing on the wall for the 60/40 portfolio?

"Alternatives have an important role to play, from loans to infrastructure, to aircraft leasing to renewables, to specialist investment approaches"

Once viewed as a relic of the past, the traditional 60/40 portfolio has made something of a comeback in the past year.

The MSCI World index made a sterling gain of nearly 23 per cent in 2019 as loose monetary policy, among other factors, helped push equities higher. At the same time, strong demand for safe-haven assets triggered a further tumble in government bond yields.

This has extended a recent run of strong returns for those using traditional balanced portfolios.

But portfolio manager Chris Forgan and co-manager Charlotte Harington, who recently took over investment responsibilities on the Fidelity Multi Asset Open fund range, say late-cycle market dynamics will require a different approach.

“Traditional balanced portfolios have certainly been strong performers in recent years, but we believe that as we get further into the late cycle and volatility picks up it is important to have the ability to broaden out portfolio holdings beyond equities and bonds,” Mr Forgan explains.

“Alternatives have an important role to play here, from loans to infrastructure, to aircraft leasing to renewables, to specialist investment approaches. The universe is highly heterogenous and research is critical.”

This mindset feeds into how the five funds under the team’s control are run: the managers focus on building well-diversified portfolios with significant flexibility to capture alpha from different sources and to weather shifts in market dynamics.

Each fund is designed with risk-based outcomes in mind.

The managers will continue to deliver total return solutions and we will continue to utilise opportunity sets

Though not specifically managed to sit within these bands, Fidelity Multi Asset Open Defensive and Strategic have Distribution Technology risk ratings of 3 and 4, respectively, at the start of this year, while the Growth and Adventurous offerings each have ratings of 6.

For clients with a higher risk appetite, Fidelity Open World had a rating of 8. The funds focus on total returns: Defensive aims to deliver an average return of 4 per cent a year over five to seven years, for example. They are also designed to outperform their peers.

The managers have an unconstrained investment universe to enable a flexible approach, but all within a set investment framework. The managers, aided by a team of analysts, monitor pertinent investment indicators, from the relative performance of different asset classes to monetary and fiscal policy, as well as how assets are priced compared with historical averages.

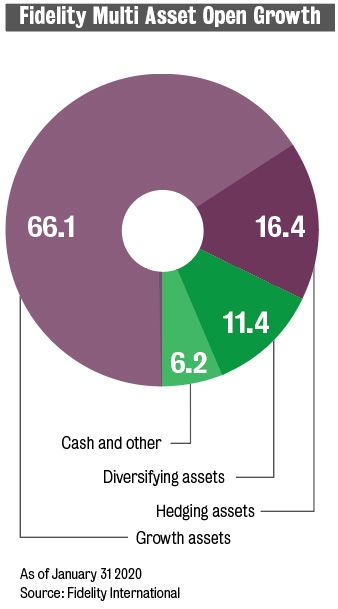

The team’s outlook will dictate how they allocate to three different asset class groups within the funds.

The ‘growth assets’ category, which can include the likes of stocks, offers the highest risk and reward, while a ‘diversifying assets’ bucket, which can take in the likes of commodities and property, allows the team to spread risk further across markets.

The third group, ‘hedging assets’, can include assets such as gold, aimed at preserving capital in difficult conditions.

A look at recent allocations offers a glimpse of how this stacks up. The Defensive fund had a 40 per cent allocation to hedging assets at the end of 2019, with 18 per cent in diversifying assets and 16.9 per cent in cash, uninvested cash and other assets.

Growth assets made up a quarter of the fund’s assets. By contrast, the Open World fund had a 93.7 per cent allocation to growth assets.

A broad range of assets comes into consideration, from developed and emerging market equities to infrastructure, emerging market debt, high-yield bonds, property, listed alternatives and fixed income absolute return strategies.

Investments are made using a multi-manager structure, via Fidelity funds and selected third-party products.

The team can use tactical asset allocation, enabling them to take advantage of shifts in the market.

All these processes are ones that the managers, who take over on the funds from Bill McQuaker, will continue to take advantage of.

“We have no plans to change the process and the products themselves,” Mr Forgan said in a recent interview. “They will continue to deliver total return solutions and we will continue to utilise the opportunity sets.”

He added that tactical “tilts” in the portfolio would continue, as will a focus on bottom-up selection of the best underlying funds.

These are all areas where, Ms Harington argues, the “breadth and depth” of Fidelity’s resources can put the range ahead of other multi-asset offerings.

Fidelity’s size means that it can dedicate teams to separate elements of the investment process, from analysts who focus specifically on fund selection to asset allocation and quant specialists.

The managers can also draw on insights from their colleagues elsewhere in the business, as Mr Forgan notes.

“We have those teams in multi asset but we have colleagues in equities and fixed income as well,” he says. “We can draw on that from the bottom up to get a sense of what’s driving companies at any point in time.”

With valuations looking extended on traditional asset classes, diversification could pay off in the event of a market turn.

In recent months, for example, the team has been focusing on using both physical gold and shares in gold mining companies as a hedging asset.

While gold typically serves portfolios well in moments of risk-off sentiment, it could also benefit from other developments such as a widely mooted weakening in the US dollar.

If the dominance of the greenback may end, the team is also looking at the possibility of other shifts in power.

or example, the managers have focused on the idea of reflation by going long energy stocks and financials.

From the coronavirus outbreak to tensions between the US and Iran, global developments and market reactions have remained impossible to predict. An extensive level of diversification may be one answer to the problem.

"From the coronavirus outbreak to increased US-Iran tensions, global developments and market reactions have remained impossible to predict"

Q&A with Chris Forgan

Fidelity's Multi-Asset Open range portfolio manager discusses how to navigate an increasingly volatile investment universe

"Once we have identified areas opportunity it's about selecting the best instruments through which to gain that exposure"

Q&A with Chris Forgan

Fidelity’s Multi-Asset Open range portfolio manager discusses how to navigate an increasingly volatile investment universe

As geopolitical relations remain fragile, the coronavirus breaks into new continents and the UK’s place on the global trade map remains a source of uncertainty, calling the shots as a multi-asset investor can seem an impossible task.

Markets have been unpredictable, equities are potentially tumultuous and low bond yields have pushed investors into increasingly risky asset classes.

So how does a multi-asset manager navigate such an environment?

Chris Forgan, the new lead portfolio manager on Fidelity’s Multi Asset Open range, reveals his thinking.

What experience do you bring to your role within the Fidelity multi-asset team?

I have been in asset management for over 20 years now and most of my experience has been within multi-asset, either as an analyst or portfolio manager looking after funds across the risk spectrum.

Within Fidelity, my role as a portfolio manager has seen me manage several different investment strategies from a total return perspective. My responsibilities include idea generation, portfolio construction, risk management and ownership of the overall decision-making process.

What are the key attributes of the Multi Asset Open range?

The five funds within the range aim to deliver an expected risk-adjusted return of between 4-7 per cent for clients who have varying degrees of risk appetite.

There are no defined benchmarks, allowing us the flexibility to capture alpha across a diverse range of opportunities including traditional and non‑traditional asset classes. This can include diversifying into areas such as alternatives.

The fund range offers a fully open architecture approach to strategy selection, typically accessing underlying actively managed strategies from across the investment industry, and is designed to balance risk, return and cost.

Talk us through your investment process — how do you determine the fund’s asset allocation and the type of company to invest in?

One of the most important aspects of our process is research. Our process begins with ascertaining the market backdrop, starting with an assessment of the macroeconomic environment.

To help develop this analysis we utilise our specialist research functions such as global macro and markets research as well as quantitative research teams.

The focus is on understanding the drivers of the market environment. Fundamentals, such as where we are in terms of market cycles, economic, credit, policy and earnings.

Valuations, to help understand attractiveness both absolute and relative, while technicals help us consider factors like investor positioning, flow data, market sentiment and momentum, enabling us to build up a picture of the global landscape.

From there, we decide where to allocate capital to take advantage of opportunities.

Once we have identified areas of opportunity it’s about selecting the best instruments through which to gain that exposure, perhaps a certain investment manager, style focus or specific factor exposure we want to pinpoint to take advantage of over the coming months and years.

How have you found your time at the helm of the fund since you took over in January? Have there been any surprises or favourite moments so far?

It has been a relatively short period of time to really assess things.

In terms of positive news flow, we have seen the lifting of some of the global market headwinds over the course of the last couple of years.

These include the trade dispute and the UK’s relationship with Europe, where we finally got some answers, which meant near-term risks have dissipated somewhat, enabling risk assets to rally as a result.

Alongside of this we have seen geopolitical risk ratchet up once again, this time in the Middle East at the start of the year, as well as a shock with the onset of the coronavirus, which has clearly created volatility and uncertainty across asset markets in quite short order.

So, it has been an eventful first few weeks the year.

What is your outlook for the markets? Where do you think we’re heading?

Markets found themselves at an interesting juncture coming into this year, following very strong stock market performance in 2019, not just in terms of absolute returns but also of the breadth of positive returns.

Such performance came at a time when the economic fundamental data was less than supportive, highlighting a substantial dislocation between the two.

This creates an element of concern going forward about the ability for stock prices to remain well underpinned, and raises questions over whether or not growth data will reaccelerate as we move through the weeks and months ahead.

Recent incoming data has been improving somewhat but remains unconvincing so far in terms of a market turnaround, with the virus outbreak likely to weigh on the data in the near term.

We continue to therefore monitor upcoming data closely for changes in dynamics.

Also, the earnings picture needs to justify the multiples of expansion we have seen in the past 12 months.

This is going to have to be substantial and, with start of the year consensus expectations of around 10 per cent year-on-year earnings growth, it still does not look hugely attractive relative to where stock market prices are today.

Critical to all of this remains central bank policy, which rode to the rescue again last year, with a global synchronised response in terms of interest rate easing, but also through some major central banks restarting asset purchases as well as liquidity provisions.

If growth and earnings fail to return then central banks will continue to be the anchor, leaving stock markets potentially vulnerable, should that anchor move.

It is a tumultuous time to be analysing the world stage. How do issues like the US presidential election, Brexit and the coronavirus impact your investment decisions?

We have moved through a milestone in the UK as a withdrawal agreement has been agreed. We now move into a trade negotiation, likely to be even more challenging. This, coupled with the fact there is a tight timeline on the agreement of the trade negotiations and expectations that both sides are after quite different results, means that Brexit will continue to add volatility to UK assets.

What will be interesting about the US presidential election is who will gain the democratic nomination – will it be a more centrist democrat or one that has of a more left-leaning bias? The outcome could potentially have a profound effect on some asset classes in the US, like technology and healthcare.

The coronavirus was an event no one could have predicted, resulting in a heavily sentiment-driven marketplace over the course of the past few weeks, which has seen volatility increase and asset prices swing in each direction subject to the latest news flow.

What is your favourite defensive asset to use to hedge the fund?

We believe in gold’s status as a safe haven.

Gold as a hedge against risk asset downturns is one of the most commonly associated drivers of the gold price.

But this was not factored into gold’s trajectory in any major way in 2019.

We have continued to see risk assets perform strongly despite some volatility in recent months, and risk assets overall are pricing in dovish central banks as opposed to struggling fundamentals.

Indeed, we recently saw US equity markets again hit an all-time high-water mark.

But if this trajectory was to reverse and we were to see a sell-off in risk assets, we believe the precious metal’s status as a safe haven would be supportive of the price.

What are the biggest hurdles facing multi-asset managers at the moment?

One of the biggest challenges for multi-asset managers has been the lack of volatility in the marketplace.

We have seen exceptionally strong returns across most asset classes in the past decade.

This means the diversification argument has been watered down to some degree, as it’s been an exceptional decade for total returns across a variety of asset classes.

For multi-asset managers, this means carving out an area of the market of its own has been less obvious than it has been in the past.

So the opportunity lies ahead, as in the next decade we are less likely to see the returns we have seen over the past 10 years.

We are likely to see greater volatility by virtue of being closer to the end of this expansion phase. Having a well-diversified multi-asset strategy should allow clients to mitigate some of these challenges as we move through the next decade.

What do you hope to achieve with the range throughout 2020 and beyond?

We hope to achieve good risk-adjusted returns for our clients with a focus on the downside.

We must remember that it is important to mitigate periods of market volatility or weakness to protect a client’s capital, whilst looking to participate during market rallies. This is a key characteristic of what we are looking to achieve with the Open franchise in the months and years ahead.

Important information

This information is for investment professionals only and should not be relied upon by private investors. Past performance is not a reliable indicator of future returns. The value of investments and any income from them can go down as well as up and you may not get back the amount invested. Investors should note that the views expressed may no longer be current and may have already been acted upon. The Fidelity Multi Asset funds use financial derivative instruments for investment purposes, which may expose the fund to a higher degree of risk and can cause investments to experience larger than average price fluctuations. Investments in overseas markets, changes in currency exchange rates may affect the value of an investment. The value of bonds is influenced by movements in interest rates and bond yields. If interest rates fall and so bond yields rise, bond prices tend to fall, and vice versa. The price of bonds with a longer lifetime until maturity is generally more sensitive to interest rate movements than those with a shorter lifetime to maturity. The risk of default is based on the issuer's ability to make interest payments and to repay the loan at maturity. Default risk may therefore vary between different government issuers as well as between different corporate issuers. Sub-investment grade bonds are considered riskier bonds. They have an increased risk of default which could affect both income and the capital value of the fund investing in them. Changes in currency exchange rates may affect the value of investments in overseas markets. Investments in small and emerging markets can be more volatile than other more developed markets. Reference to specific securities should not be construed as a recommendation to buy or sell these securities and is included for the purposes of illustration only. Issued by Financial Administration Services Limited, authorised and regulated by the Financial Conduct Authority. Fidelity, Fidelity International, the Fidelity International logo and F symbol are trademarks of FIL Limited. UKM0220/26764/SSO/NA